Strength in Numbers

Empire Startups Contributor Trisha Kothari dives into how harnessing collaboration and consortium data can lead toward a fraud-free future.

Hi there,

It's been less than a year since I last wrote about fraud, yet so much has changed in that short time. But if there is one thing that’s stayed consistent for any financial institution—be it a bank, credit union, or Silicon Valley FinTech startup— it is the ongoing need to stay ahead of fraud and bad actors. The FTC continues to find that U.S. consumers lose big regarding fraud. In 2023, that number surmounted to over $10 billion, a 14% increase from 2022.

No matter what part of the fraud problem we solve within the financial services industry, we are in this fight together. As technology advances, creativity and collaboration between financial institutions are more critical than ever.

Data & Collaboration

Fraudsters are known to be some of the most entrepreneurial and creative people. They often collaborate, making tackling fraud rings at scale extremely difficult.

But with access to the correct data, we can also take an entrepreneurial, collaborative spirit. Fittingly, over the past few months, we’ve seen multiple consortiums pop up, not to mention incumbent players like Early Warning and more. Built, owned, and operated by the seven largest banks in the United States, Early Warning started one of the most successful consortiums for banks and credit unions, with solid data coverage from over 2,500 FIs. It has served as the benchmark for fraud consortiums in the traditional finance sector.

But there is still room to grow.

For example, as of now, only chartered financial institutions can participate in the Early Warning Consortium. Of course, FinTech comes with challenges, given its wide variety of use cases, risk thresholds, and regulatory landscapes. However, we must be included in the conversation alongside the traditional financial players to build an all-inclusive community of insights.

This one consortium has provided great collaboration and successful data sharing to combat fraudsters—but is just scratching the surface of what’s possible when working together.

Community Over Competition

With the ongoing trend to digital banks, neobanks, and crypto, fighting fraud through a consortium via FI data is fighting half the battle. Morning Consult found that in 2021, 10% of Americans are unbanked, and 24% are underbanked. While the “good guys” are often left at a disadvantage; needing to adhere to numerous laws and regulations, such as where and how they operate, what information is disclosed, and to whom–collaboration across the full range of financial services providers is a non-negotiable in 2024.

A comprehensive consortium approach encompasses all data sources and collaboration across financial institutions and fintech. Given that many fintechs are on a mission to create a more inclusive financial system, neobanks, and digital banks are going to be able to help complete the data picture.

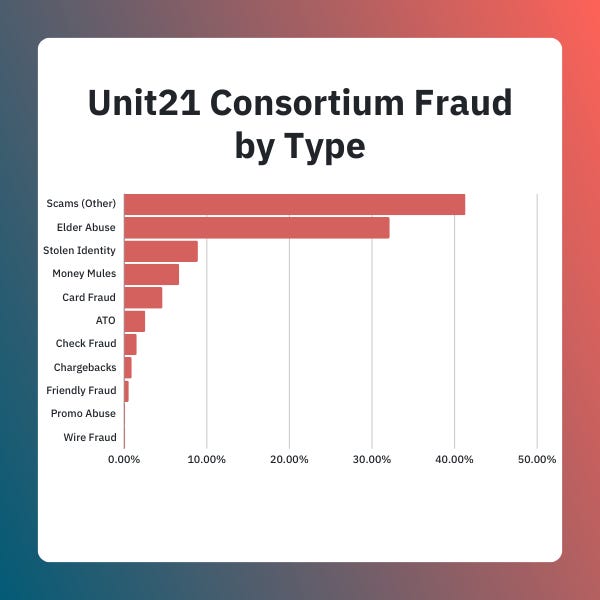

Let’s look at some insights recently gleaned from having this type of FinTech collaboration involved at the forefront:

Digging into the data, we can see that elder abuse is unfortunately representing a significant portion of identified fraud at over 32%. With this, moving beyond mere reporting to proactive prevention is crucial. While the ABA advises financial institutions to report elder financial exploitation to FinCEN, participating in a consortium allows for a more dynamic approach, preemptively identifying and flagging known perpetrators, effectively barring them from the financial system.

Transparency: The New Currency

Sure, there are bitcoin and NFTs, but we think there is a "new" currency that is just as powerful: transparency. The value of transparency in building customer trust and industry resilience cannot be stressed enough. A recent Ipsos report found that the reputation of financial services has improved markedly in recent years. But there is still work to be done. The report also found that "[being open] and transparent about what it does" tied for second in "drivers of trust in banking - what attributes have the greatest impact."

Trust and transparency are essential for financial institutions, especially as more Personally Identifiable Information( PII ) data is shared daily. Because of this, sharing and analyzing data for fraud prevention by participating in a consortium has traditionally had a high barrier to entry for many organizations. However, a comprehensive defense strategy that integrates vast data sources is highly valued when done correctly.

For example, if one institute flags a fraudster account, the consortium proactively alerts all other members, preventing a chain of fraud and shutting down all related accounts.

Beyond the Buzzwords

Financial institutions must consider going beyond buzzwords or what's "hot" and instead focus on data and knowledge sharing within and across organizations. Creating a think tank culture will help organizations stay ahead of sophisticated fraud schemes without spending too many resources or too much time.

—

Trisha Kothari, Co-Founder & CEO of Unit21, Empire Startups Contributor

Empire Startups Contributors are a community of experts providing unique perspectives and insights on the latest in FinTech. Our model is is merit-based and does not offer monetary compensation.

If your email client clips some of this newsletter, click below to see the rest.🎟 Featured FinTech Events

ATLANTA

NEW YORK

OTHER CITIES

SAN FRANCISCO

VIRTUAL

🗞🎧 The latest news in FinTech.

Reads

📈 Nasdaq's revenue beats on strong demand for fintech product | Reuters

Revenue from its financial technology unit surged 71% to $392 million in the first quarter, while revenue from its index business jumped 53% to $168 million.

⛔️ Republic First Bank seized by regulators, sold to Fulton Bank | Axios

The Fed's rate hikes have slashed the value of many banks' assets. When those banks are losing money, as Republic was, they're likely to fail.

🌎 Visa Teams With AWS to Streamline Cross-Border Payments | PYMNTS

Among the first services available as part of the new arrangement is Visa Cross-Border Solutions, which helps streamline cross-border transactions and the holding of multiple currencies.

👀 Stripe reopens crypto payments with USDC focus | Yahoo Finance

The decision to support stablecoin payments offers a less volatile alternative to traditional cryptocurrencies and aligns with Stripe’s positive stance on the potential of digital currencies.

Listens

🗣 Itai Damti, Unit CEO: Evolving as an Industry, Company, and Leader | Fintech Family Hour

Today on the episode we welcome back Itai Damti, CEO of Unit. If you’re in the know, you’re probably aware of alllll the drama going on in BaaS, and if you’re finding for more of whats happening. You’ve come to the right place.

🏦 Digital Banking Trends in the U.S. | Fintech Futures: What the Fintech?

In the latest episode of the What the FinTech? podcast, we’re joined by Sonali Divilek, Head of Digital at Chase, to find out more about how consumer attitudes towards digital banking in the US have changed in recent years.

Sonali and FinTech Futures editor Paul Hindle take a look at some of the key consumer trends highlighted in Chase’s recent Digital Banking Attitudes Study and the factors behind these, as well as how banks can respond to shifting consumer demands and tap new technologies to boost areas such as personalisation to ensure their digital channels are meeting customers’ wants and needs.

🚀 Featured FinTech Funding

PRE-SEED

Bokra, $4.6M (Wealth Management, Egypt)

SEED

Bump , $3M (Accounting/Finance, Los Angeles)

SERIES A

401GO , $12M (Wealth Management, West Jordan)

Upflow , $5M (Payments/Billing, New York)

Pomelo , $35M (Money Transfer/Remittances, San Francisco)

💼 Featured FinTech Jobs

New York

Founding Engineer , Interfold

BDR - US Market , Upflow

Senior Account Operations Manager , Scaler

Payment Operations Manager, Capchase

Remote

Commercial Counsel , Stride Funding

Business Development Manager , Counterpart

Senior Actuarial Manager, Car , Lemonade

Senior Medical Director, Clinical Programs , Oscar

San Francisco

Analytics Manager , Pomelo

Director, FP&A , Human Interest

Head of Product Marketing , HoneyBook

Marketing Automation Manager , LendingClub