More Users Are Coming to Crypto, Here’s How To Not Screw It Up

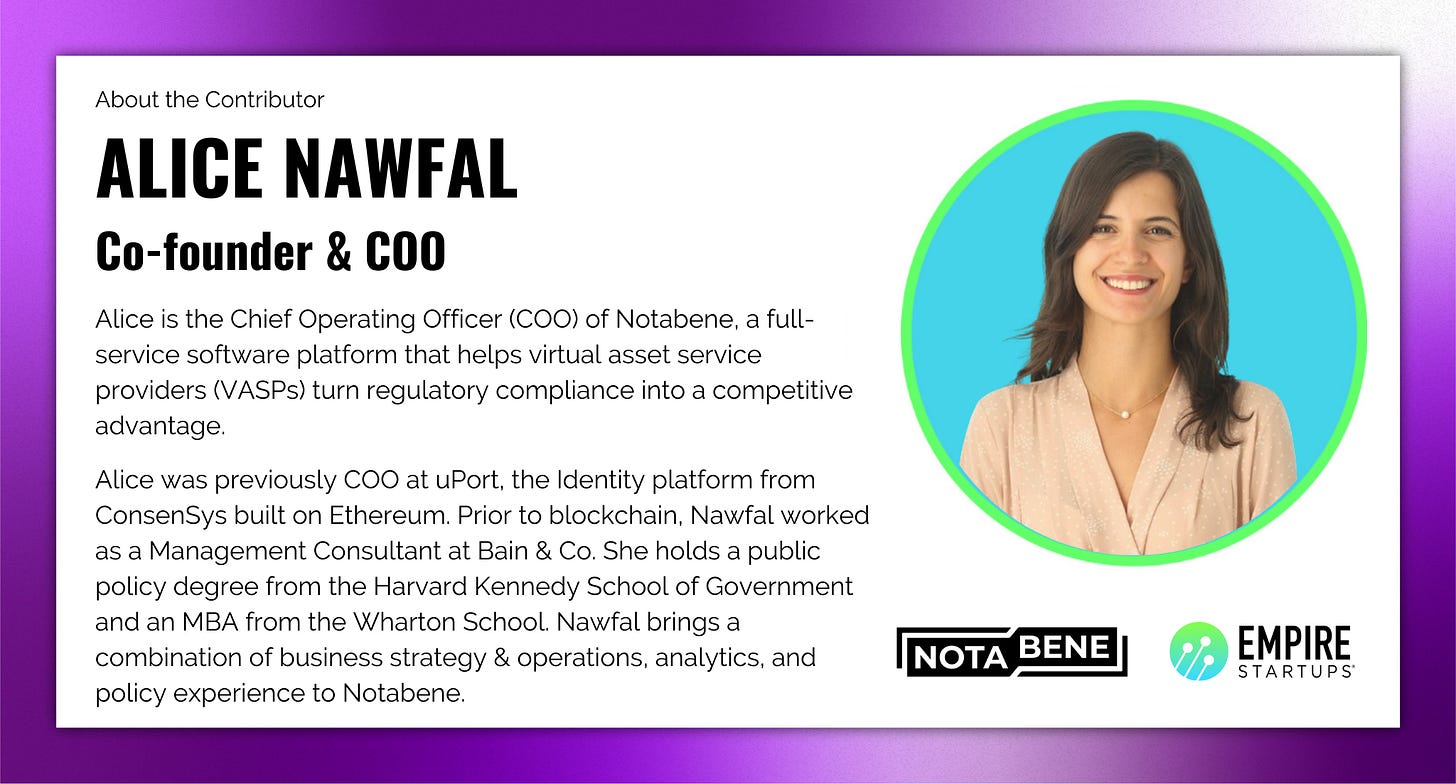

Empire Startups contributor Alice Nawfal shares how the 'tipping point’ is more in our hands than we think.

Hi there,

The crypto industry is teetering on the edge of widespread adoption, which can feel like déjà vu. Once again, there is massive interest from financial giants and emerging market retail users alike.

As an industry, we’ve advanced significantly, creating valuable products for daily use and collaborating with asset managers and trading firms to launch innovative yield-bearing financial instruments. Global regulatory clarity, from the UK to Hong Kong, has leveled the playing field, offering a pivotal opportunity for a real break-out opportunity.

Yet, this time feels different. Or at least, it should.

The collapse of FTX and the subsequent $150 billion loss from the market cap loom as recent reminders, along with the fresh wounds of large-scale scams and ransomware attacks that plagued the last bull market. These events have eroded user’s trust, a crucial element that's challenging to restore.

Simply put, we must do things differently this time.

The lingering shadows of past experiences underscore the imperative need for us to apply a security and compliance-first approach to growth. By placing trust and transparency at the cornerstone of our product offerings, we can unlock the vast potential we've been promising over the last decade.

A Surge Like No Other

The first quarter of 2024 has already witnessed an unparalleled surge in crypto activity. The launch of Bitcoin ETFs has attracted significant attention from major financial institutions, prompting the virtual asset to shatter multiple all-time heights. This surge is driven by institutional interest and unprecedented inflows into US ETFs, peaking at over $1 billion on a single day in March.

Bitcoin has surpassed gold in investment portfolios, highlighting its growing acceptance and increasing confidence among financial analysts. Ethereum ETFs are also on the horizon, and Wall Street analysts share predictions of the crypto market cap tripling to $7.5 trillion by 2025. Many believe that these estimates are conservative.

These statistics mark just the beginning of a rebound, starting with low-risk allocations in Bitcoin ETFs, signaling a sign of pent-up institutional demand. The promise is real; we’re standing at the tipping point of broader institutional adoption of crypto, as real-world institutional utility into areas like payment, tokenization, stablecoins, and staking are right around the corner.

Retail demand lags behind past highs but is nonetheless rebounding, as the allure of unlocking new value and access to frictionless payments has captivated retail users in emerging markets. Retail demand is demonstrated by the stablecoin market expanding for the first time in more than 18 months, surpassing $146bn. Additionally, in recent weeks, the daily trading volume of crypto exchanges hit $100 billion for the first time since 2021.

All these tailwinds signal a growth cycle like no other. However, this current bull run is occurring during a sweet spot, a unique time of greater regulatory clarity, as evidenced by financial hubs and major economies like Singapore, the UAE, and the EU enforcing licensing regimes and anti-money laundering rules for crypto asset service providers.

Building Trust

The impending breakout moment: The markets are rife with analyst projections, and the overall answer is, "It is yet to be seen" amidst an interplay of supply and demand market forces. However, as industry veterans, we must leave speculation to the analysts and take a hard look in the mirror. If we focus on what is in our control, it is clear that the ‘tipping point’ is more in our hands than we think.

There has been a clear trend of high demand for years now. That has only grown. But what is also clear is that unless we tackle headlong putting safety and security at the center of our products and aim to boost trust in this space, broader adoption of real-world utility will remain out of our reach.

To the builders in the space, working through the noise of the bull market tempts you to allocate most of your resources to exciting new products that promise a lot of revenue. But that can be at the expense of building more secure infrastructure and ensuring safe customer transactions. Indeed, focusing on trust, transparency, and regulatory compliance — the boring stuff — will get us to the next growth phase. While the use cases will bring the next hundreds of millions of users to crypto, the boring stuff will ensure they stay for the long run.

As an industry, the tipping point is upon us.

Here's what we need to do to not "screw it up" this time:

Invest in long-term regulatory strategy when expanding geographically: Companies should carefully craft comprehensive regulatory strategies to address future challenges as they expand into new markets. Investing today in doing so correctly will reduce the risks of fines and other legal pitfalls in the long run.

Innovate your product with security in mind: Allocate top talent to building compliance and security into the product from day one. We have an opportunity to build systems that work better than what financial institutions are used to - ones that provide end users with more security and reduce illicit finance at a much higher rate.

Give compliance teams a seat at the table: Integrating compliance deeply into the business model ensures that growth is always in step with regulatory requirements rather than at odds. This is key to embedding trust and reliability into the foundation of the business.

Education and transparency: Openly communicate your security and compliance efforts, educating users on how their financial transactions are secured and what best-in-class practices you have rolled out. Transparency in these areas will build trust and confidence and act as a competitive advantage.

Collaborative innovation: Proactively lead industry efforts that set new standards to enhance innovation in security and compliance. Allocate your brightest teams to educate broader industry partners like traditional financial institutions and learn from them.

By embracing the above strategies, the crypto industry can navigate its expansion with integrity, paving the way for a future where cryptocurrencies are widely adopted, trusted, and integral to the global financial landscape.

—

Alice Nawfal, Co-founder & COO of Notabene, Empire Startups Contributor

Empire Startups Contributors are a community of experts providing unique perspectives and insights on the latest in FinTech. Our model is is merit-based and does not offer monetary compensation.

🎪 2024 Empire FinTech Conference

We’re in the home stretch, and time is ticking to grabbing your ticket before it’s too late!

Need any more convincing? We’re excited to announce our third fireside chat, with Danielle and Leah Cohen-Shohet of GlossGenius, moderated by Axios’ Lucinda Shen. Click below👇 to learn more about what they’ll be discussing on the Empire stage.

If your email client clips some of this newsletter, click below to see the rest.🎟 Featured FinTech Events

NEW YORK

SAN FRANCISCO

OTHER CITIES

NY FINTECH WEEK 2024

Hosting an event during NY FinTech Week? Learn how to get it added to our official calendar. Attending NY FinTech Week? Keep scrolling for 40+ events taking place throughout the city.

Monday

Tuesday

Wednesday

Thursday

Friday

🗞🎧 The latest news in FinTech.

Reads

🤝 Visa and Mastercard agree $30bn settlement over US transaction fees | FT

The deal, announced on Tuesday, will require the payments companies to lower the so-called swipe fees they charge sellers over the next five years.

💳 Robinhood’s new credit card goes after Apple Card with ability to invest cash-back perks | TechCrunch

Eight months after acquiring credit card startup X1 for $95 million, Robinhood announced today the launch of its new Gold Card, with a list of features that could even give Apple Card users envy.

📈 15 Months After FTX, Trust In Web3 Technology Has Never Been Stronger | Forbes

How did the digital assets markets make such a rapid turnaround in under two years?

🤑 Chime Plans to Launch IPO in US in 2025 | PYMNTS

The FinTech company aims to do so in the United States but has not yet engaged banks for the IPO, Bloomberg reported Friday (March 22), citing unnamed sources

👀 Millions of older adults with student debt are at risk of losing some Social Security benefits, lawmakers warn | CNBC

The U.S. government has extraordinary collection powers on federal debts and it can seize borrowers’ tax refunds, wages and retirement benefits.

Listens

🗽 Jon Zanoff Founder of Empire Startups - Building the NY FinTech Community | Wharton FinTech Podcast

Previously featured on the Wharton Fintech Podcast before, Jon is the founder of Empire Startups, one of the the largest FinTech communities of entrepreneurs, investors, bank innovators, and operators. As a FinTech legend in New York, Jon is back on the show to share latest updates about Empire Startups and the New York Fintech Week on Apr. 8th - Apr. 12th.

🗣 The Fintech OG Series: Frank Rotman and Nigel Morris | This Week in Fintech Podcast

In episode number four of the Fintech OG series, we talk with Frank Rotman and Nigel Morris, the founders of QED Investors and two of the architects of what became Capital One.

🚀 Featured FinTech Funding

SEED

Dolomite.io, $900K (Blockchain/Crypto, Metuchen)

FlexPoint, $5M (Accounting/Finance, Manhattan)

Blockhouse Digital, $2M (Blockchain/Crypto, Dallas)

Borderless AI, $20M (Payments/Billing, Toronto)

SERIES A

Copilot, $6M (Personal Finance, New York)

Marco, $12M (Lending, Miami)

👉 Want more? Find our full funding report here.

💼 Featured FinTech Jobs

New York

Senior Product Manager , Coast

Director, Marketing Operations , Justworks

Facilities Manager , Clear Street

Marketing Technology and Operations Manager , Riskified

Remote

Sr. Staff Software Engineer , Wisetack

Compensation and Workforce Planning Analyst , NextInsurance

Customer Success Quality Assurance Manager , Flex

Director, Content , Carrot Fertility

San Francisco

Social Media Manager , Amber

Staff DevOps Engineer , Figure

Accounting Manager , Affirm

Commercial Counsel , Finix