Getting to the “Top of the Wallet” Part II

The importance (or lack thereof) in financial literacy.

Hi there,

What does the path to “top of wallet” look like?

Back in August, I began to dissect this question, which stirred interesting responses from other product and strategy friends throughout FinTech. The question isn’t an easy one to answer, and becomes even trickier when thinking through how a customer might define this phrase.

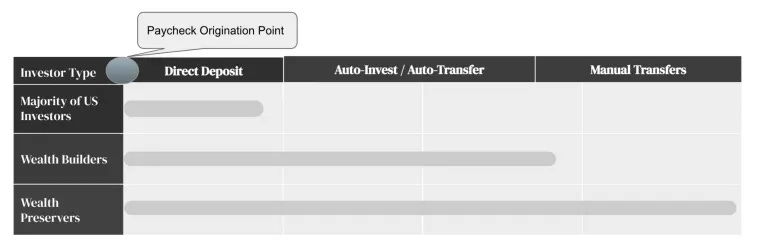

As a quick recap, I attempted to explain our discoveries of a FinTech product’s:

a) proximity to the paycheck origination point; and

b) the length of time remaining to the individual’s retirement.

A third argument introduces the ‘z’ axis on a map of FinTech users: the financial savviness of the individual.

How well do they understand our financial system and its various verticals? What level of competence do users in the U.S. have with respect to how each wallet segment affects other segments?

Literacy and its ailments

The most prevalent theme we found amongst investment platform power users was a desire to passively use investment products, particularly as they climbed the wealth ladder. The higher an individual’s income, the more likely they were to prefer passively investing the majority of their portfolio–even when many of these individuals worked within the investment management or asset management industries.

My inference is that, all other things equal, if your income increases, you will optimize your time by seeking the highest-quality products to invest/save/spend your money with, and carry on without having to actively manage your funds.

The rationale behind this behavior? Higher-income individuals want to maximize their time. This is done by using investment products that do not require constant, active management.

This makes more sense if you contemplate that financial advisors are typically leveraged by wealthier individuals; similarly, robo-advisors (what the industry dubs an “automated investing” advisor) are a product targeting the upper-middle class.

But, what does this mean for financial literacy?

Beyond the Hype

As I took more time to examine the second and third order effects of this, I realized that the lower one’s position on the U.S. socioeconomic ladder, the more likely it is that they lack an understanding of how our financial system operates.

It’s no secret that financial literacy is something that we struggle with in the U.S., particularly when it comes to groups that need the education most.

While some of this misunderstanding may stem from a lack of financial literacy – particularly among newcomers to the U.S. unfamiliar with its incredibly complex system (e.g. migrants) – I would argue that much of it is fueled by online fear, uncertainty, and doubt that misleadingly equates financial literacy with trading proficiency.

It’s widely recognized that the trading excitement of the last few years has revealed a stark reality: True financial literacy is often absent in this realm, with decisions frequently based more on “vibes” than solid financial understanding.

Interestingly, in an annual survey conducted by TIAA and the Global Financial Literacy Excellence Center, only 37% of Americans accurately answered questions about risk. The survey concludes that only 20% of U.S. adults possess a high level of understanding of financial concepts, including investing and saving.

This abhorrently low percentage signals something much worse to me, which is that we have a lot of America using a lot of investing apps and frighteningly, the vast majority do not understand what they’re doing.

A Passive Solution

Our research, corroborated by numerous studies, reveals a compelling truth: The majority of the U.S. population could significantly benefit from adopting passive investing strategies to achieve more effective success.

I’m not advocating to stop the trading altogether–unless, of course, you have something better to do with your time than buy puts on the latest short sale recommendation from your local shill site. I love the desire to learn; embracing the innate need to educate oneself through direct action is something I practice as well.

As a simple example, the concept that owning investment real estate can yield higher returns but demands significant effort– which might not justify the opportunity cost of pursuing other ventures– holds true for all types of investing. This is a core reason why passive real estate investing, such as REITs, exist.

In every major investing sector, there’s a product designed for passive investing. However, the challenge in the investing industry is that passive investing lacks the allure often associated with more active strategies.

Retail trading product developers face a conundrum: balancing the best interests of investors with those of their highest revenue products. The crux of the issue is that retail trading generates revenue through transaction volume. Essentially, the revenue stems from active trading! Options, crypto, and the once-famous PFOF (payment for order flow) represent a few examples of the many fees that aren’t always transparent in transactions.

So how can developers craft offerings that balance the inclusion of necessary fees with the best interests of their users?

The focus would have to be on educating around the importance of passive investing. However, the current content often ends up promoting trade execution, options, and other expensive investing concepts, thereby exacerbating issues of financial literacy rather than alleviating them.

With few exceptions, the UX/UI of your favorite investing app likely does not promote passive investing. Rather, the app likely gives you more tools and more capabilities to do more nuanced trades, often regardless of your true trading literacy.

The friction of wanting to make money on your product vs. considering the best interests of your investor is very, very real.

Not to leave you all on a cliffhanger once again… But look out for a third piece on the matter, coming soon.

—

Saira Rahman

VP, New Investor Initiatives at Fundrise, Empire Startups Contributor

The Empire Startups Contributor Cohort is a community of experts providing unique perspectives and insights on the latest in FinTech. Our model is is merit-based and does not offer monetary compensation. You can learn more about our contributors here.

🎪 2024 Empire FinTech Conference

We’re in the home stretch – a.k.a. just 5 weeks out until the big day. Time is ticking on grabbing your ticket before our FINAL price jump. 👇

In anticipation of NY FinTech Week 2024, the Empire team took to the streets to see *just* how much people know about our industry. The result? ... Let's just say it's a good thing you all will be here soon. 😉

🎟 Featured FinTech Events

NEW YORK

OTHER CITIES

NY FINTECH WEEK 2024

Hosting an event during NY FinTech Week? Learn how to get it added to our official calendar.

Monday

Tuesday

Wednesday

Thursday

If your email client clips some of this newsletter, click below to see the rest.🗞🎧 The latest news in FinTech.

Reads

🏦 Consumers Like Open Banking Features, Now Banks and FinTechs Need to Deliver | PYMNTS

Younger consumers and frequent receivers both said they are comfortable connecting payouts directly to their bank accounts through an open banking arrangement if it means faster transactions.

📲 Credit Unions: Generating Value Through Digital Ecosystems | FinTech Magazine

Modern-day credit unions are getting on board with sizeable shifts in the finance industry, leveraging fintech partnerships to improve their technical infrastructure and deliver personalised experiences to customers Magazine

📑 Experian consumer credit reports to include Apple Pay Later information | Finextra

Experian has announced it will be the first credit bureau to include Apple’s buy now pay later (BNPL) loan information on consumers’ credit reports.

💳 CFPB puts credit card comparison sites on notice | PaymentsDive

The CFPB found that comparison sites often allow card companies to bid for preferential placement in comparison lists, allowing the company to target certain customers or meet certain volume goals.

🆕 Robinhood launches a retirement plan for gig workers | FastCompany

A growing number of people are moving away from the usual 9-5, shifting towards freelancing and side hustles to make a living. But traditional systems haven’t caught up.

Listens

🗣 The Discover/Capital One Merger, Lineage’s Latest Consent Order, Inflation Affects Tooth Fairy Pricing | Fintech Takes

On this week’s episode of Fintech Takes, Alex is joined by international man of mystery and publisher of

, Jason Mikula, along with the Ghost of Fintech Future and cruise director of New York FinTech Week, Jon Zanoff.First up, the guys discuss the latest in the Capital One/Discover deal and debate the nature of mergers and acquisitions. Are M&As inherently bad for fintech? How do they impact innovation and why are consumers usually the victims of consolidation? They break down the ways that M&As affect the competition cycle and ponder what the Capital One/Discover deal means for the larger credit card industry.

Then, the guys take a trip back over to BaaS Island where things have devolved into a “Lord of the Flies” situation. Alex, Jason, and Jon unpack Lineage’s latest consent order with the FDIC and discuss why regulators are so obsessed with fast deposit growth. Which leads them to ask the question—exactly what standards should we be measuring BaaS bank size by?

Plus, think your founder is bad? Meet the founder of Zera who raised $2.2 million from investors only to use it on… horseshoes and tropical fish? And later, Alex tries to determine just how much inflation has affected the Tooth Fairy’s pricing structure and Jon reveals what he’s looking forward to most about New York Fintech Week 2024.

And if you haven’t already, be sure to grab your Empire FinTech Conference ticket! Receive 15% off with Promo Code BAASISLAND.

🚀 Featured FinTech Funding

PRE-SEED

Cleva, $500K (Digital Banking, Middletown)

Miden, $500K (Digital Banking, Lewes)

Clasp, $1.5M (Core Technology,New York)

SEED

Nest Wallet, $3.6M (Blockchain/Crypto, San Francisco)

Myko AI, $3.6M (Accounting/Finance, Scarsdale)

SERIES A

Kickfin, $3M (Payments/Billing, Austin)

Coverdash, $13.5M (InsurTech, New York)

SERIES B

Helcim Inc., $20M (Payments/Billing, Calgary)

💼 Featured FinTech Jobs

New York

Ethics & Compliance Operations Manager, Workday

Business Continuity Director , Payoneer

Business Operations Manager , Robinhood

Head of Customer Success US , ComplyAdvantage

Remote

Senior Partnerships Manager , Coverdash

Senior Full-Stack Software Engineer , EasyKnock

Product Engineer , Clasp

Sales Manager , SmartAsset

San Francisco

Senior Director, Banking Strategy & Operations , Chime

Fraud Risk Analytics Manager , SoFi

Director, Technical Solutions and Support , Sift

Group Product Manager, Platform , Rocket Money