Beyond Easy Money

A retrospective on the themes that took over FinTech in 2023, and what's on the horizon for 2024.

Hi there,

Earlier this month, I had the pleasure of taking part in the closing fireside at the Innovation on the Rise Conference, brought to you by Rise by Barclays. The half-day acted as a retrospective on 2023 with a look towards what’s on the horizon for 2024.

Kicking off the afternoon, Nicole Casperson (Founder, Fintech is Femme) reminded us that FinTech is hard for a reason:

“No one in FinTech comes into this industry because we’re here to build something easy.”

I’m not the first to tell you that the market in these past 12 months have been anything but easy (Hello, BaaSplosion, CFPBoo, interest rates, inflation, job cuts, SMB banking debacle, downrounds, etc., etc., etc…)

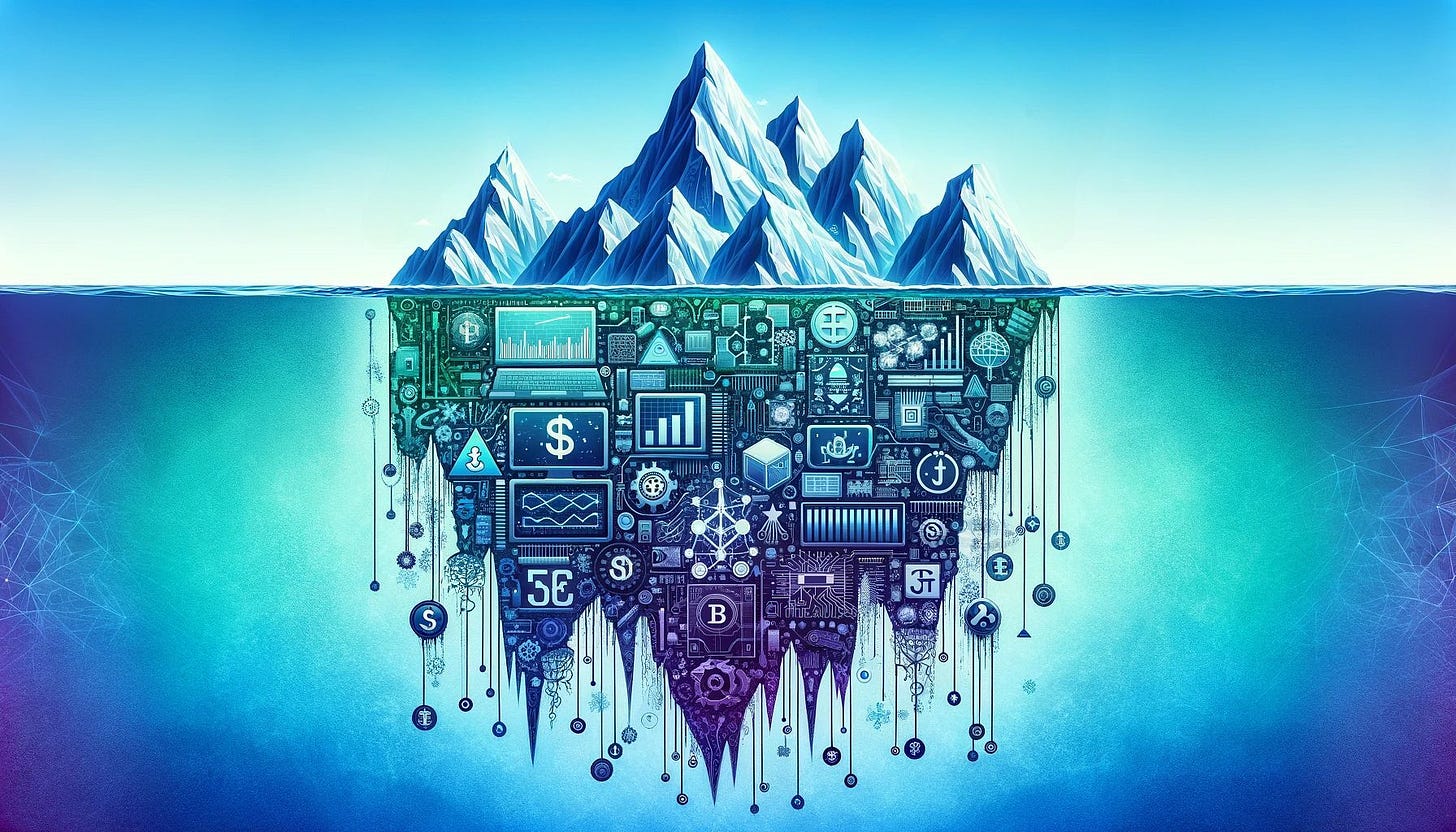

So, the era of “easy money” is gone, and founders are back to figuring out how to de-risk their ideas with limited capital.

Is this a bad thing?

As Nicole eluded, the entrepreneur's journey isn't about going over mountains but explicitly choosing to go through them.

Anyone who’s ever landed at LGA knows a little turbulence before landing is to be expected. The Innovation on the Rise Conference focused on the strategic shifts that need to take place in order to move the FinTech narrative forward.

In 2024, founders will focus on de-risking a business with limited resources and creating enough value to retain not just acquire customers.

Let’s dive in to some of the key areas, discussed:

Adoption of AI

While artificial intelligence – and even language models – are not something new, the conversation around AI in FinTech continues to grow.

(Are you even on Substack if you don’t mention AI?)

Generative AI is… generating hype. But can it generate value?

Chloe Zhu, Director of EnsembleX, questioned product-market fit on her panel. She kicked off the conversation asking who from the audience paid for their own AI avatar. After a few hands rose, she then asked those same hands if they had used that same AI product ever again.

As you can guess, hands then fell to zero.

While her question not only provided laughs, it also underscored a necessary shift – from pure acquisition to retention. Just because there is initial allure, doesn’t mean the product will stick, or there’s a viable business model.

I have no doubt AI will continue to be the #1 trending topic in 2024, as well as continue to get heavily funded, and provide valuable solutions in the FinTech space.

But we must shift from disrupting stock photography to disrupting banking cores.

Capital Efficiency

Last April, TechCrunch posted that in 2022, 90% of VC meetings with startups would have been about growth with little regard for retention. In 2023, the same fleece vests were likely cutting burn at all costs, with little regard to ROI.

Yep, the same patagonia that pushed mega rounds in 2021, blindly pushed austerity this year. But hey, even a blind squirrel can find a nut once in a while and this shift was the right call… The only call. I welcome less banter about island offsites, swag, and burning man and more about creating value.

An overcorrection is a very real risk. Abdul Abdirahman, (dynamite) Investor at F-Prime Capital, shared how the austerity strategy can hinder players in the space:

“Recently, there has been so much focus on profitably. At earlier stages, thinking like that can be detrimental to growth.”

While slashing marketing and go to market efforts will lengthen your runway, it’s more of a stay of execution. Pausing your top of the funnel while simultaneously watching the goal posts move further away is a slow and painful demise.

2024 will continue to be challenging for both founders and investors. But great companies are built during difficult times.

A Brighter Future Ahead?

So Jon, what does this mean for FinTech? What can we expect moving forward?

All good things. A re-focus on building enduring value, wildly exciting new AI technologies, less venture-backed boondoggles and hoodies, and a lot of capital in the system.

My fireside, ‘Brighter Future Ahead in 2024?’ aimed to turn that question mark into a period.

While there are various opinions when it comes to the future of bank and FinTech partnerships, what is clear is that banks are currently under pressure, and insanely hungry for technology.

And there is still an unbelievable amount of opportunity.

A little optimism in your inbox as a holiday treat? We’ll take it! See you in 2024.

Cheers,

Jon

🎪 Empire FinTech Conference 2024

Crossing things off your 2023 to-do list? Here’s an easy one: Secure your tickets for the 2024 Empire FinTech Conference.

Get ready for a jam-packed day with power-packed keynotes, hands-on masterclasses, live podcasts, cutting-edge demos, and priceless networking opportunities. Don’t miss out on the most important FinTech event on the East Coast.

🗣 Last Call: Call for Content 2024

Is thought leadership on your roadmap for 2024? What’s top of mind, and who should be speaking about it?

We're in the final weeks of our call for content, a chance to submit your ideas for the opportunity to take place on the Empire stage this April. Don’t miss out on the chance to help shape our agenda!

🎟 Featured FinTech Events

NEW YORK

SAN FRANCISCO

Start planning for NY FinTech Week 2024

📆 DEADLINES

Applications are open for a chance to be one of the companies pitching at our 2024 Financial Wellness Pitch Day, in partnership with the AgeTech Collaborative™ from AARP.

This event is a kickoff into NY FinTech Week, where participants will get the chance to connect with top mentors and judges. The winning pitch not only receives $10,000 but gets the opportunity to pitch on the Empire FinTech stage later that week.

A reminder that registration for this event is free.

If your email client clips some of this newsletter, click below to see the rest.🗞🎧 The latest news in FinTech.

Reads

⏰ Visa Adds Real-Time Money Movement to FinTech Fast Track | PYMNTS

The move expands the program beyond card issuance and gives members access to real-time money movement capabilities.

🤝 TD inks data access deal with Plaid | FinExtra

TD customers will be able to connect to and share financial data with Plaid's network of over 8000 apps and services through APIs.

📲 How Google Pay Has Defied The Odds In India | Forbes

The payments app has 67 million users in India, by far its largest single market – Google Pay has roughly 150 million users globally.

🌎 The world's biggest digital bank is based in Brazil—and it's eyeing financial inclusion in Mexico next | Quartz

Nubank's Cristina Junqueira explains how new digital products are bringing banking to Mexico.

Listens

🤔 Not Fintech Investment Advice: Wellahead,Increase, Ribbon, Conduiit | Fintech Takes

Simon’s out on paternity leave (don’t worry—it’s not like he’s catching up on any lost sleep), but thankfully, we’ve found an awesome substitute — the man, the myth, the early-stage investor extraordinaire, Jared Franklin, who’s helping Alex Johnson to break down some interesting fintech startups

🏆 Meet the 2023 11:FS Hall of Famers | Fintech Insider by 11:FS

In this special episode of Fintech Insider, we speak to some of this year's exceptional 11:FS Hall of Fame inductees about their game-changing contributions to fintech.

🚀 Featured FinTech Funding

PRE-SEED

Liquidium, $1.3M (Blockchain/Crypto, Delaware)

Crowda, $2M (Mortgage/Real estate, Austin)

SEED

Woveo, $1.7M (Lending, Calgary)

Hive Wealth, $3.4M (Wealth Management, Bethesda)

💼 Featured FinTech Jobs

New York

Marketing Program Manager, Payoneer

Senior Technical Program Manager, Platform, Gemini

Senior Director, Corporate Strategy, Oscar Health

Community Partnerships Manager , Otis

Remote

Sanctions and PEP Screening Manager, Binance

Marketing Manager, CrowdStreet

Director of Sales, IEX Group

Director of Sustaining Engineering, NYMBUS

San Francisco

Business Operations Director, People Team, SoFi

Startups Ambassador, Brex

Sr. Program Manager, Live Chat, Chime

Investor Relations Senior Manager, Ripple

Happy Holidays!! Ya, there difference between value and worth concept, great talks