Beyond the Bear Market: Maintaining Momentum Against Challenges

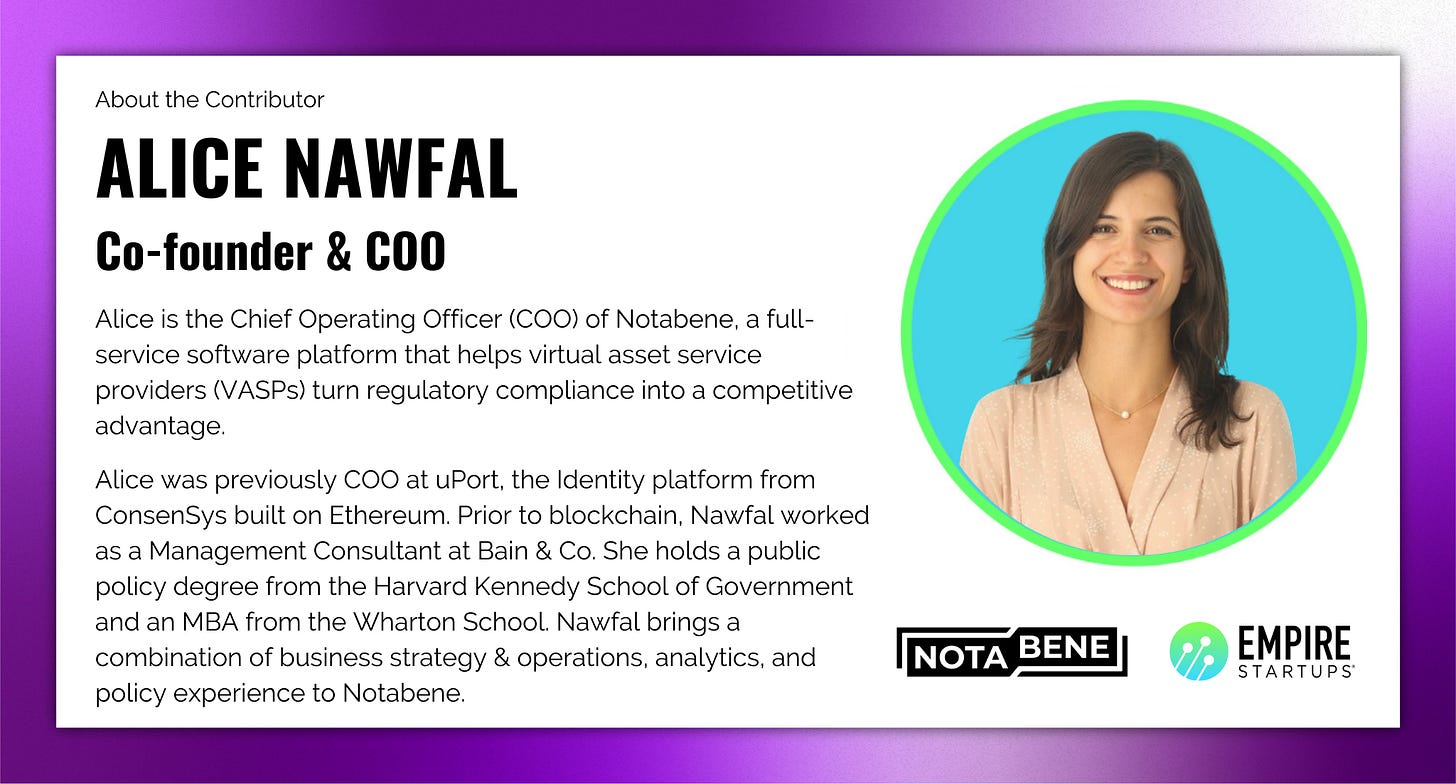

Alice Nawfal shares her experience and motivations for moving forward in challenging environments.

Thanks for coming back to the Empire Startups newsletter, where we’re bridging the gap between FinTech founders, investors, employees, & enthusiasts. New here? Subscribe to get our newsletter sent straight to your email.

Hi there,

As an early-stage founder, timing is crucial. But more often than not, timing is something you have little to no control over.

Let's take it back to 2022, for example. The year began with “FinTech,” and specifically “crypto,” as buzzwords, highly praised and equally funded. Yet, during the year, the sentiment immediately took a turn. Suddenly, several of your customers are out of business. Many begin asking for discounts as they tighten their operations. Every time you turn on the news, it feels like a downward spiral. And your total addressable market? Shrinking.

It is challenging enough to build and grow a business in stable market conditions. But now, investors and operators are debating whether there is any merit to blockchain technology at all.

For the past year, this has been my reality. As the COO of Notabene –a software provider that empowers companies to transact compliantly with crypto assets – my role involves leading our commercial and operations strategy to achieve growth.

A (Brief) Look Back

Whether you've been closely following the market trends or just catching the headlines, you can't escape the seismic shifts happening in the crypto industry. The past year has seen a series of events that shook consumer and institutional confidence—from geopolitical tensions affecting crypto sanctions to significant liquidity issues at major exchanges. These setbacks collectively led to decreased investments, closed businesses, and project delays:

February 2022: The Russia-Ukraine war led to tightened sanction requirements in the crypto sector.

May 2022: TerraUSD broke its peg to the dollar, setting off a chain reaction affecting many exchanges and financial institutions.

November 2022: FTX, the second-largest crypto exchange, faced a liquidity crisis, leading to the CEO stepping down.

March 2023: Silicon Valley Bank, a major banking partner for many crypto businesses, was among several bank failures.

Each of these events was significant in its own right. When considered together, they had a compounded impact. Consumer and institutional confidence dropped, leading to reduced liquidity pools, the closure of crypto firms, and delays in crypto product launches by major banks and FinTechs. Looking ahead to 2024, the industry faces persistent challenges, with slow market recovery and regulatory ambiguity looming large.

“How do you build a high-performing team that you can continuously motivate and inspire? How would you do that within this past year's dynamic, unpredictable market and during a bear market?”

These are just two questions reverberating through founders' heads during market downturns, along with balancing sheets, OKRs, and remembering to schedule a dentist appointment.

Steps to Move Forward

I have a strong background in navigating industry downturns, notably as the former Head of Operations of uPort, a leading Ethereum-based digital identity solution.

During a period where most blockchain projects struggled to find customers and were mainly funded by large corporations for innovation purposes, I focused on bringing our product to customers who already had a clear use for it, bear market or not. Crypto winter was impossible to escape, especially on budgets. We had to restructure the team while also trying to keep engagement levels high.

A few strategies during this time, and even now, that I lean on for remaining agile in challenging periods:

Hold strong views, loosely held: Be ready to adjust your market forecasts as new information comes in.

Build for tomorrow, today: Focus on the long game. Ensure that your current efforts are enough to meet future demands.

Be curious: Today's trends and use cases could quickly become obsolete in a fluctuating industry. Immerse yourself in their world; the constant learning will help to navigate through uncertainties.

Take calculated risks: Big jumps can yield high rewards, whether it's entering into a new partnership or introducing features for an emergent market segment. The midst of a bear market often presents fertile ground for big bets.

Optimism never hurts: Even failures breed learnings. What can this situation teach me to adapt better and innovate?

Communicate openly: Your team is reading the same headlines as you are or dealing directly with customer churn. Maintaining a culture where leadership can acknowledge difficulties and encourage open discussion is vital to building trust and fostering collaborative problem-solving.

“Spring”-ing Ahead

Despite the setbacks, a brighter future for crypto seems to be on the horizon. Leading financial institutions like JPMorgan, Citi, and Franklin Templeton are actively embracing asset tokenization. JPMorgan, for example, recently executed its first live, blockchain-based collateral settlement transaction alongside industry giants BlackRock and Barclays. Using blockchain to digitize assets like money market funds and real estate, asset tokenization is poised to disrupt traditional finance, with market projections soaring to $16 trillion by 2030.

On the consumer front, crypto is maturing beyond mere speculative trading. The stablecoin market is poised to expand to $2.8 trillion within five years. Regulated crypto assets are taking the lead, and they are built compliantly, with strict oversight and consumer protection measures embedded from day one.

For consumers navigating the ever-changing landscape of FinTech, these developments bring promising changes. Imagine more user-friendly platforms that feel safe to transact on, opportunities to diversify your investments with confidence, and financial products that are becoming increasingly accessible. With traditional financial giants embracing asset tokenization and regulated crypto assets, it's not just about speculation anymore – it's about real-world financial services evolving to meet consumer needs for protection and stability.

In a market known for its volatility, keeping a focus, high-performing team is not just beneficial, but crucial. Adhering to our guiding principles has positioned Notabene to thrive amid industry fluctuations.

The current challenges are shaping a more resilient and adaptive crypto industry. Signs are pointing toward a new phase of growth and innovation. The evidence strongly suggests that we stand on the brink of a technological revolution with the potential to reshape global financial systems.

Bear markets don't just reveal the robust companies; they create them. The hardships faced today are laying the groundwork for tomorrow's successes.

–

Alice Nawfal, Co-founder & COO of Notabene, Empire Startups Contributor

Empire Startups Contributors are a community of experts providing unique perspectives and insights on the latest in FinTech. Our model is is merit-based and does not offer monetary compensation.

🎟 Featured FinTech Events

MIAMI

NEW YORK

OTHER CITIES

🗞🎧 The latest news in FinTech.

Reads

🤑 Americans can’t (and won’t) stop spending in 2023 | Axios

"The death of the U.S. consumer has been vastly over-exaggerated.”

💰 Armed with $40M in fresh capital, fintech Stash says it’s moving toward an IPO | TechCrunch

Stash intentionally opted not to raise more capital via the venture route in large part due to market conditions.

🥧 Growing the Real-Time Payments Pie, Not Fighting Over Profits | PYMNTS

With two real-time services and platforms on offer, the question remains as to whether financial institutions (FIs) will jockey to pick a rail and whether FedNow and TCH will compete for differentiation.

🛣 Plaid hires first chief financial officer on road to potential IPO | FT

A milestone in its highly anticipated plans to go public following a failed sale to Visa two years ago.

🙅 Goldman Sachs Wants Out of Consumer Lending. Employees Say It Can’t Happen Fast Enough | WSJ

If Goldman can ditch the product, it will effectively spell the end of the Goldman consumer-lending experiment.

Listens

🔓 Stablecoins Going Mainstream | Breaking Banks

With banks unlocking crypto, what does it mean for the future of finance?

🤝 Ushering in a new era: The fusion of fintechs and banks | OneVision

At a time when financial institutions and fintechs are evolving from being competitors to partners, our relationship with financial services providers is changing as well. How will this web of relationships redefine the future of financial services? What role will data and emerging technologies play?

🚀 Featured FinTech Funding

PRE-SEED

CashEx, $100K (Digital Banking, Cambridge)

SelectFI Lending Solutions, $1.9M (Core Technology, Erieville)

SEED

WebStreet, $2.3M (Wealth Management, Wilmington)

Shur, $100K (Personal Finance, New York)

StoreCash, $1M (Payments/Billing, San Jose)

SERIES A

Grow Credit, $10M (Lending, Santa Monica)

Canopy, $15.2M (Core Technology, San Francisco)

SERIES B

Matic Insurance, $17M (InsurTech, Columbus)

💼 Featured FinTech Jobs

New York

Senior Accounting Manager (Hybrid role), Wingspan

Senior Customer Success Manager , Forter

Email Marketing Manager , Beacon Platform

Associate General Manager , Narmi

Remote

Senior Technical Program Manager (DevOps & InfoSec Enablement) , Tango Card

Strategy & Operations Director- Cybersecurity , Marqeta

Product Communications Lead , Paxos

VP of Marketing , Esusu

San Francisco

(Senior) Marketing Analyst , Prosper Marketplace

Lead Operations Workforce & Capacity Planning Analyst ,Earnest

Senior Associate, Strategic Finance , Carta

Senior Data Engineer, TIFIN